World’s Richest Banker

Edmond, Joseph, and Moise Safra

Jacob Safra (1891-1963) was born to a religious Sephardic family in the Jewish community of Aleppo, Syria. He was from a long line of Ottoman merchants and bankers. When the Ottoman Empire collapsed, Safra opened a new banking business in Beirut. His bank soon became the most trusted financial institution for the region’s many Jews. When things became difficult in Arab countries following the establishment of the State of Israel, Safra moved his family (with four sons and four daughters) to Italy, and then to Brazil. There, Safra and his sons founded a new bank in São Paulo in 1955. While eldest son Elie Safra (1922-1993), and third son Moise Safra (1934-2014) played smaller roles in the family business, the most prominent of the brothers was undoubtedly Edmond Safra (1932-1999). He opened a branch in Geneva, and transformed an initial $1 million into $5 billion in less than three decades. He also founded the Republic National Bank of New York, which grew to 80 locations, making it the third largest bank network in the city (after Chase and Citigroup). Edmond later opened financial institutions in Luxembourg and Russia. The latter would prove unfortunate, as many believe his “accidental” death in a house fire may have been an assassination by Russian mobsters. Today, Banco Safra is run by youngest son Joseph Safra (b. 1939). His net worth is estimated around $25 billion, making him the richest banker in the world. The Safras have always been famous for their incredible generosity. They have funded countless schools, hospitals, universities, and charities. Edmond Safra was particularly interested in building and restoring Jewish sites, and paid for synagogues all over the world, including in Manila, Istanbul, and Kinshasa. He financed the first new synagogue in Madrid in 500 years, and saved an ancient synagogue in France from demolition. He also refurbished and funded the tombs of Rabbi Meir and Rabbi Shimon bar Yochaiin Israel, and prayed at the tomb of the former each year before the holiday of Shavuot. Several medical centres and university faculties around the world bear his name, and the Safra family was one of the founders of São Paulo’s most renowned hospital. He established the International Sephardic Education Foundation to provide scholarships for those in need, and the Edmond J. Safra Philanthropic Foundation continues to give millions to charity each year. The Safras stay out of the public eye, and hold on to their faith – as well as a strictly kosher diet. Most recently, they paid for the beautiful new Moise Safra Centre in Manhattan.

15 Life Lessons from King David

Words of the Week

If you believe breaking is possible, believe fixing is possible.

– Rabbi Nachman of Breslov

In 2014, Joseph Safra purchased one of London’s most iconic buildings, the Gherkin (left), for a whopping £700 million. The Safras also own the General Motors Building in Manhattan (bottom centre), and fund (clockwise from top) the American University of Beirut, the Edmond and Lily Safra Children’s Hospital in Israel, the Edmond J. Safra Synagogue of New York, and the tomb of Rabbi Meir – a popular pilgrimage site.

The eldest son of

The eldest son of

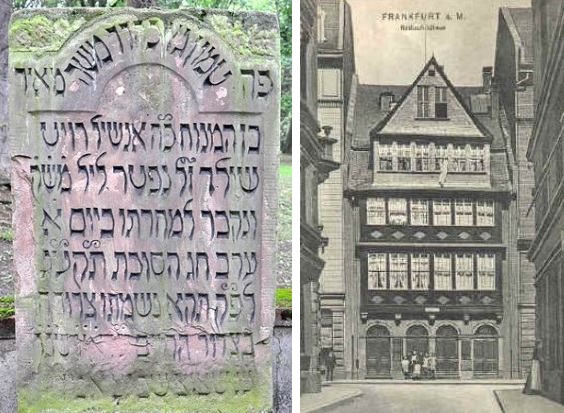

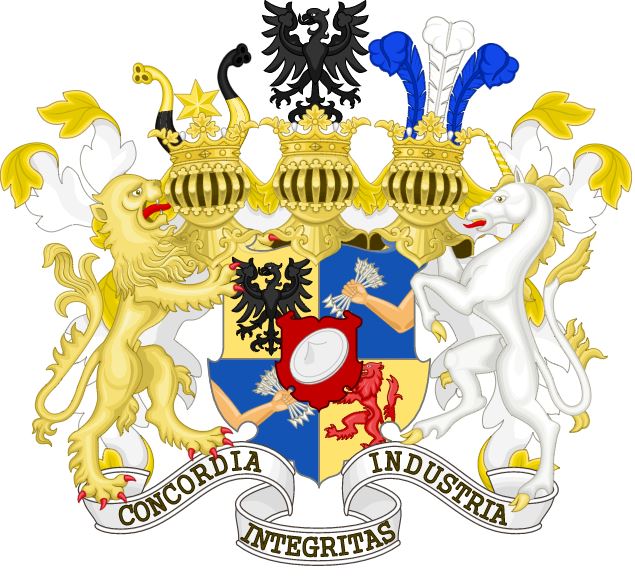

Mayer ben Anshel Rothschild (1744-1812) was born in the Jewish ghetto of Frankfurt. His father was a merchant and dabbled in currency exchange. The family had lived in the same house of the Frankfurt ghetto for over a century; a house with a red sign above the door. The family would thus become known as Rothschild meaning “red sign”, referring to that first house, even when they later moved to another property in the ghetto. Although his father wanted him to become a rabbi, Mayer Rothschild became an apprentice of Simon Wolf Oppenheimer, a banker and “Court Jew”. (Some say Mayer had to leave his rabbinic studies after his parents died.) From Oppenheimer he learned the financial business, and become a dealer of rare coins. This brought him into the court of the Prince of Hesse (a duchy within pre-Germany’s “Holy Roman Empire”). By 1785, Rothschild had become one of the Prince’s main bankers. The French Revolution erupted just a few years later, and Britain would handle its hiring of Hessian mercenaries in the conflict through Rothschild. This made Rothschild quite wealthy, and at the turn of the 19th century, he began loaning money internationally. This business was facilitated by the help of his five sons: Nathan in London, Jacob in Paris, Salomon in Vienna, Kalman in Naples, and the eldest son Amschel taking over in Frankfurt. As the family prospered and entered into the nobility, they adopted a coat of arms, the simpler version of which features a red shield with five arrows to represent the five sons (based on the words of Kings David and Solomon in Psalm 127: “Like arrows in the hand of a warrior, so are the children of one’s youth”), and a motto: concordia, integritas, industria, “Unity, Integrity, Diligence”. Mayer Rothschild also had five daughters, and instilled in all ten of his children the importance of maintaining Jewish values. Unlike other wealthy European Jews, the Rothschilds did not assimilate, intermarry, or convert to Christianity. They played a central role in easing the plight of Europe’s Jews, and later in the establishment of the State of Israel. They would amass the largest private fortune in modern history, and possibly of all time. As per Jewish tradition, Mayer and his five sons were generous philanthropists. The Rothschild model of a tightly-controlled family business, with multiple branches established by siblings, inspired many other successful banks and companies, both Jewish and gentile. Mayer Rothschild himself has been described as the “founding father of international finance”, and ranked by Forbes among history’s most influential businesspeople. Next week we will explore the lives and achievements of his sons.

Mayer ben Anshel Rothschild (1744-1812) was born in the Jewish ghetto of Frankfurt. His father was a merchant and dabbled in currency exchange. The family had lived in the same house of the Frankfurt ghetto for over a century; a house with a red sign above the door. The family would thus become known as Rothschild meaning “red sign”, referring to that first house, even when they later moved to another property in the ghetto. Although his father wanted him to become a rabbi, Mayer Rothschild became an apprentice of Simon Wolf Oppenheimer, a banker and “Court Jew”. (Some say Mayer had to leave his rabbinic studies after his parents died.) From Oppenheimer he learned the financial business, and become a dealer of rare coins. This brought him into the court of the Prince of Hesse (a duchy within pre-Germany’s “Holy Roman Empire”). By 1785, Rothschild had become one of the Prince’s main bankers. The French Revolution erupted just a few years later, and Britain would handle its hiring of Hessian mercenaries in the conflict through Rothschild. This made Rothschild quite wealthy, and at the turn of the 19th century, he began loaning money internationally. This business was facilitated by the help of his five sons: Nathan in London, Jacob in Paris, Salomon in Vienna, Kalman in Naples, and the eldest son Amschel taking over in Frankfurt. As the family prospered and entered into the nobility, they adopted a coat of arms, the simpler version of which features a red shield with five arrows to represent the five sons (based on the words of Kings David and Solomon in Psalm 127: “Like arrows in the hand of a warrior, so are the children of one’s youth”), and a motto: concordia, integritas, industria, “Unity, Integrity, Diligence”. Mayer Rothschild also had five daughters, and instilled in all ten of his children the importance of maintaining Jewish values. Unlike other wealthy European Jews, the Rothschilds did not assimilate, intermarry, or convert to Christianity. They played a central role in easing the plight of Europe’s Jews, and later in the establishment of the State of Israel. They would amass the largest private fortune in modern history, and possibly of all time. As per Jewish tradition, Mayer and his five sons were generous philanthropists. The Rothschild model of a tightly-controlled family business, with multiple branches established by siblings, inspired many other successful banks and companies, both Jewish and gentile. Mayer Rothschild himself has been described as the “founding father of international finance”, and ranked by Forbes among history’s most influential businesspeople. Next week we will explore the lives and achievements of his sons.